Newsletter

Inside each edition of the newsletter you’ll hear from our CEO, get the latest news on our credit union and learn financial tips and strategies. New editions are posted each quarter.

2024 Quarter 1

- Hidden Savings: Commonly Overlooked Tax Deductions

- Save the Date for Our Annual Meeting

- What to Know About Adjustable-Rate Mortgages for First Time Home Buyers

Podcast

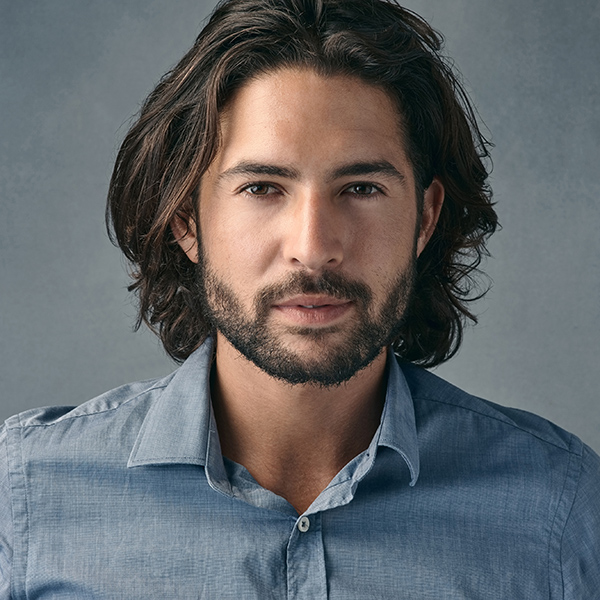

Commercial vs. Small Business Lending: Determining the Difference

In this week’s ‘On the Money,’ Orlando Credit Union’s VP of Business and Residential Services Brett Childers discusses the difference between commercial and small business lending. Tune in to find out what the application process looks like and to determine which option makes the most sense for your business. (Duration: 14:54)

AVAILABLE ON

Past Editions

2023 Quarter 4

- Insights To Identifying and Avoiding Fraud Text Messages

- Maximize Your Holiday Season with Orlando Credit Union’s Credit Card Rewards

2023 Quarter 3

- Orlando Credit Union Earns Community Development Certification to Better Serve Central Florida

- How to Combat Financial Elder Fraud

2023 Quarter 2

- Save the date for our annual meeting!

- What to Know About Auto Financing with Orlando Credit Union

2023 Quarter 1

- Turn to Orlando Credit Union to Achieve Your New Year’s Goals

- All members are invited to join us for the 87th Annual Meeting

2022 Quarter 4

- Achieve Your Financial Goals by Utilizing Orlando Credit Union’s Instrumental Products & Services

- The Benefit of Prioritizing Your Savings

2022 Quarter 3

- Become Financial Free: Strategies to Help on Your Journey

- Reach Financial Freedom with Orlando Credit Union’s Comprehensive Financial Tools

2022 Quarter 2

- Overcoming Inflation: How to Budget as Prices Rise

- How Orlando Credit Union Can Help Minimize Inflation’s Impact on Your Wallet

2022 Quarter 1

- One Step Closer to the Home of Your Dreams

- Reaching Resolutions with Wow! Rewards

2021 Quarter 4

- Earn rewards while doing your everyday banking with our NEW Wow! Rewards Program

- 5 Ways Credit Union Credit Cards Can Beat Flashy Bank Offers

2021 Quarter 3

- Four Ways Your Business Can Becomes More Resilient

- Three Trends Home Buyers Should Watch for this Summer

2021 Quarter 2

- Orlando Credit Union Is Celebrating 85 Years of Serving Members

- Member Benefits & Announcements

Past Episodes

Why Bigger Isn’t Always Better: Tools to Help Your Small Business Rival the Larger Corporations

Orlando Credit Union Business Lending Officer Tim Cahill gives us a closer look at the financial tools that benefit small businesses. For those who own or aspire to own a small business, tune in to hear about the many products and services Orlando Credit Union offers to help you rival bigger corporations. (Duration: 13:57)

Available on: Spotify - Apple - YouTube

Meet the Community Leaders: Meredith Chambers, Development Manager of the Susan G. Komen Organization

Orlando Credit Union is stepping outside of our organization and into the community in our ‘Meet the Community Leaders’ edition of the podcast. Today, we spoke with the Development Manager of the Susan G. Komen Organization, Meredith Chambers, to learn more about how Susan G. Komen impacts Central Florida. (Duration: 11:01)

Available on: Spotify - Apple - YouTube

Fraud Prevention: Red Flags to Look for During the Holiday Season

Orlando Credit Union’s Vice President of Information Technology, Victor Gonzalez, dives deeper into the importance of fraud prevention. Phishing scams are now more prevalent than ever, and knowing what red flags to look for can save you from falling victim to fraud. Tune in for tips and tricks to keep you aware and away from common scams. (Duration: 13:55)

Available on: Spotify - Apple - YouTube

Understanding the Weight of Credit Card Debt: How Orlando Credit Union Can Help

Orlando Credit Union’s Semoran location Branch Manager, Lili Patrick, breaks down what you need to know about the impact of credit card debt. Whether you’re a seasoned or first-time credit card user, staying on top of your monthly payments is crucial. Tune in for tips and tricks to manage credit card payments and pay down your debt. (Duration: 16:29)

Available on: Spotify - Apple - YouTube

What Makes Orlando Credit Union Credit Cards Unique

Orlando Credit Union’s Lake Nona location Branch Manager, Rob Houston, discusses what makes Orlando Credit Union credit cards unique. Learn about the importance of credit card utilization and the part that rewards can play in your credit card usage. (Duration: 16:30)

Available on: Spotify - Apple - YouTube

The Member Service Center: How Orlando Credit Union Utilizes This Tool to Assist Members

Orlando Credit Union’s Millenia location Branch Manager of Retail Operations, Kim Drobny, discusses how the Member Service Center, Orlando Credit Union’s call center, is utilized to assist members in daily financial transactions. (Duration: 15:00)

Available on: Spotify - Apple - YouTube

The Benefits of Auto Financing with Orlando Credit Union

Orlando Credit Union’s Apopka location Assistant Branch Manager, April Bell, discusses everything to consider when looking at auto financing options. We break down the steep monthly rates that many are paying for auto loans, and we discuss how taking out an auto loan can impact your credit score. (Duration: 16:25)

Available on: Spotify - Apple - YouTube

The Pros and Cons of Renting vs. Buying

Orlando Credit Union’s Real Estate Lending Manager, Keith Bertrand, discusses the benefits of buying vs. renting. We look at the pros and cons of both and determine how to know which option is best for you. (Duration: 17:48)

Available on: Spotify - Apple - YouTube

Commercial Banking: How to Navigate in a Changing Economy

Commercial Banker Brett Childers discusses the influence that our economy has had on commercial banking over the years. We dive into the impact of 2020’s economic state on businesses and look at best practices for companies to consider when it comes to navigating the economy. (Duration: 15:50)

Available on: Spotify - Apple - YouTube

Why Homeowners Insurance Is Essential in Florida

Orlando Credit Union’s Real Estate Lending Manager, Keith Bertrand, breaks down the importance of having homeowners insurance in Florida. With hurricane season impacting many Floridians, it’s important to know that your property is protected. Tune in to learn about the many options you have when it comes to insurance. (Duration: 18:08)

Available on: Spotify - Apple - YouTube

Bank from Anywhere with Orlando Credit Union Digital Products

In this episode we sit down with Orlando Credit Union’s Regional Manager of Retail Operations, Cody Elvin, to discuss the benefits of utilizing digital products. Find out how digital wallets can not only be a great alternative to your tangible credit card but can also be a safer option to carry around. (Duration: 18:18)

Go to main navigation